SINGLE/MULTIFAMILY HOMES

Abhishree Residency 1 , 2 , 3 , Abhishree Villa , Abhishree Orchard Abhiraj and several other projects developed under this.COMMERCIAL OFFICES/CORPORATE OFFICES

ABHISHREE ADROIT ABHISHILP COMPLEX ABHISHREE COMPLEX ABHISHEE CORPORATE PARK ABHIGAM ABHIRAJCONTRACTING PROJECTS/DESIGN-BUILD PROJECTS

30 Government Private Projects undertaken since the past 40 Years as Built UnitsHOSPITALITY

Current 2 Hospitality Projects and Others in the PipelineSquare Areas

Car Parking

Apartments

Rooms

values of smart living in vista residence

Abhishree Orchard Boasts a lot of amenities for the project

wellness

conference

restaurant

shopping

fitness

library

play area

fashion

Sports

Kids Area

Pool

Jogging

Schedule A Visit

SCHEDULE A VISIT AT ABHISHREE ORCHARD AND EXPERIENCE THE NATURE

Smart living

At vero eos et accusamus et iusto odio dignissi ducimus qui blan ditiis praesentium

ECO Construction

At vero eos et accusamus et iusto odio dignissi ducimus qui blan ditiis praesentium

Human in mind

At vero eos et accusamus et iusto odio dignissi ducimus qui blan ditiis praesentium

Atractive Location

At vero eos et accusamus et iusto odio dignissi ducimus qui blan ditiis praesentium

Modern Technology

At vero eos et accusamus et iusto odio dignissi ducimus qui blan ditiis praesentium

Awarded design

At vero eos et accusamus et iusto odio dignissi ducimus qui blan ditiis praesentium

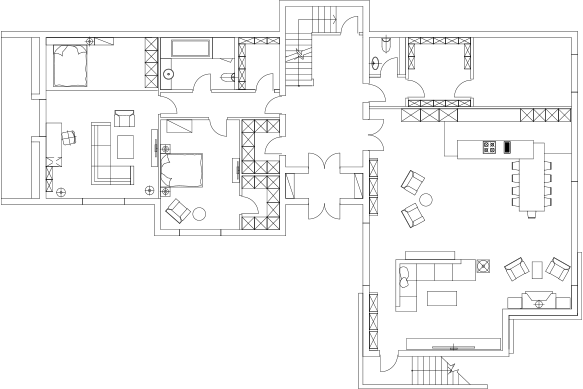

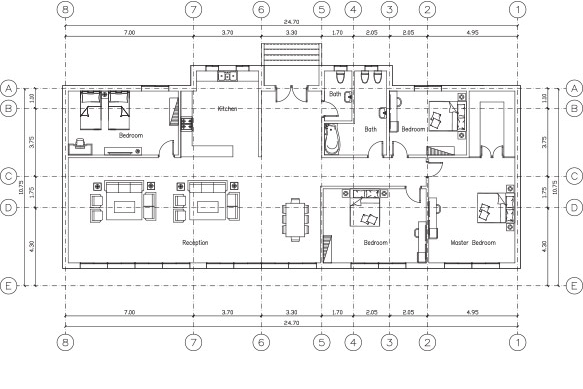

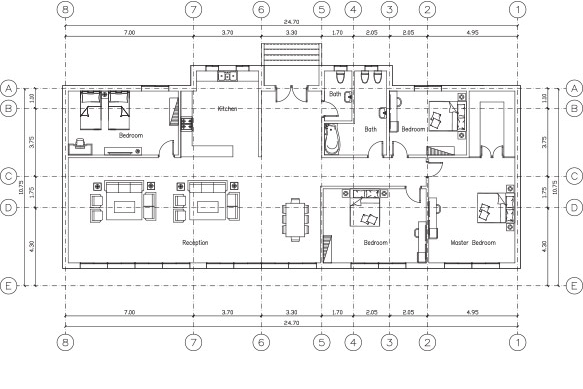

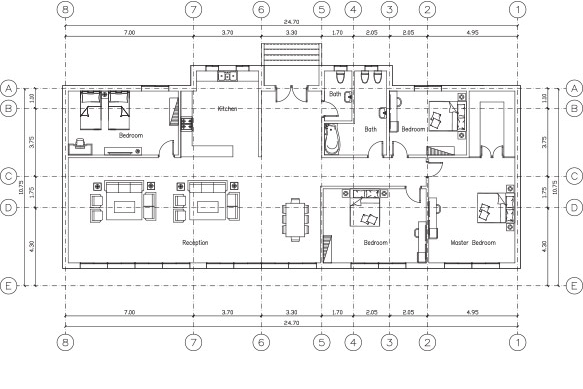

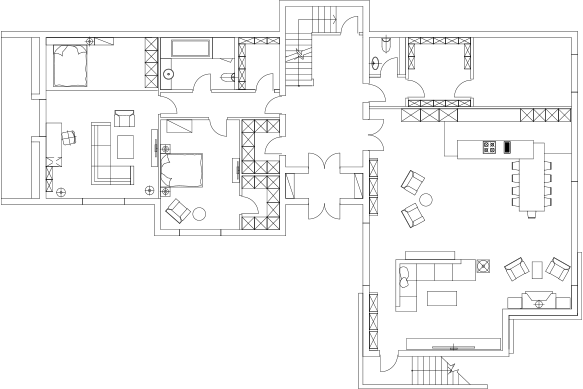

Choose a Bungalow in Abhishree Orchard

Choose from the variety of Bungalows available in Abhishree Orchard

No posts were found for provided query parameters.

At vero eos et accusamus et iusto odio dignissimos ducimus qui blan ditiis prae sentium voluptatum deleniti.

At vero eos et accusamus et iusto odio dignissimos ducimus qui blan ditiis prae sentium voluptatum deleniti.

At vero eos et accusamus et iusto odio dignissimos ducimus qui blan ditiis prae sentium voluptatum deleniti.

At vero eos et accusamus et iusto odio dignissimos ducimus qui blan ditiis prae sentium voluptatum deleniti.

At vero eos et accusamus et iusto odio dignissimos ducimus qui blan ditiis prae sentium voluptatum deleniti.

At vero eos et accusamus et iusto odio dignissimos ducimus qui blan ditiis prae sentium voluptatum deleniti.

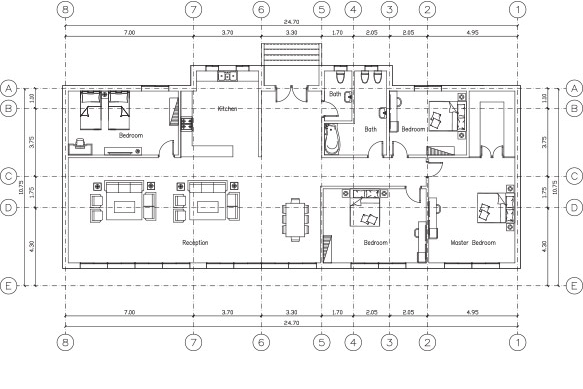

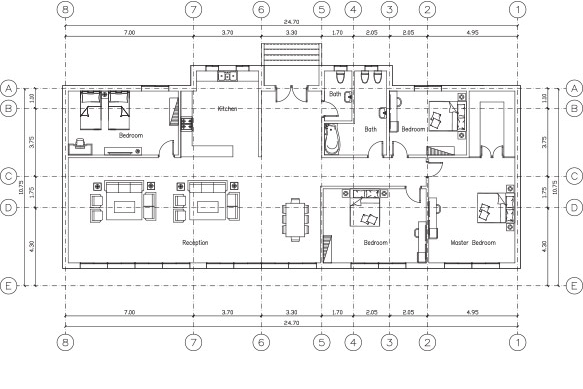

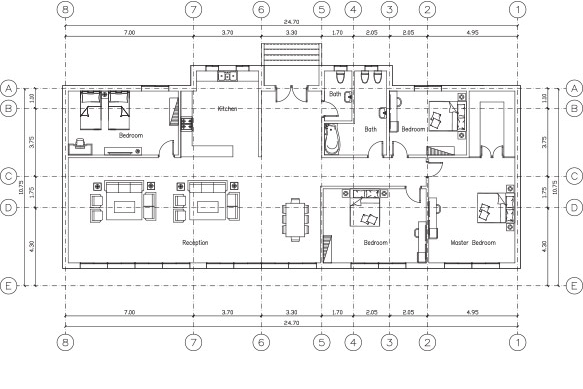

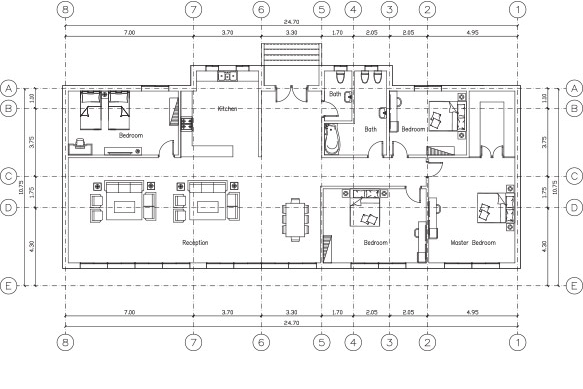

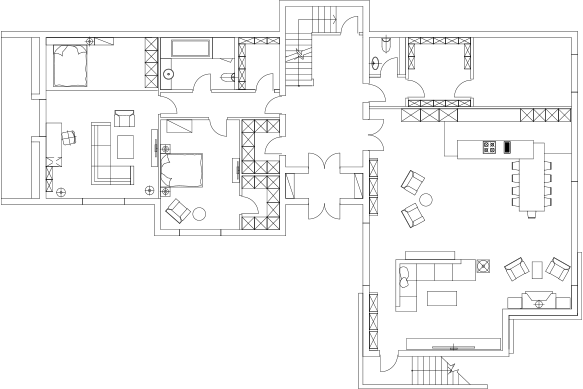

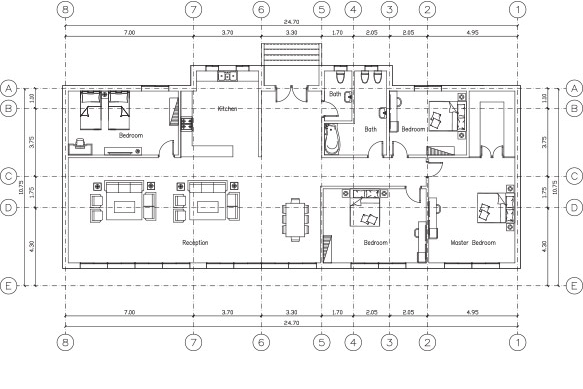

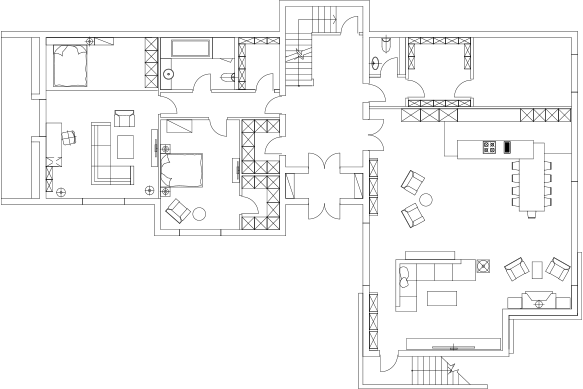

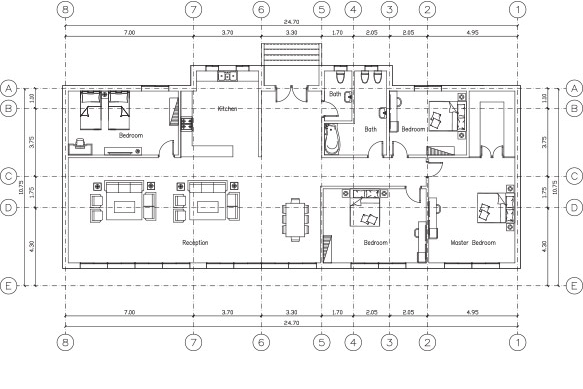

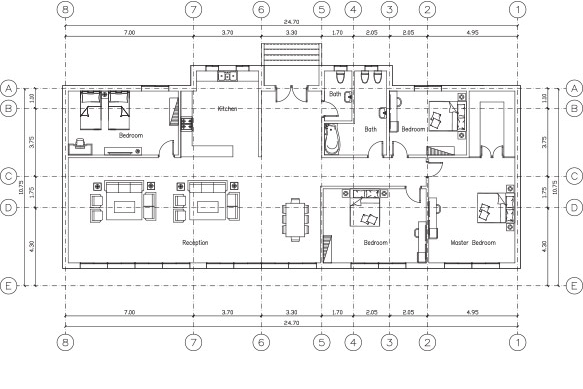

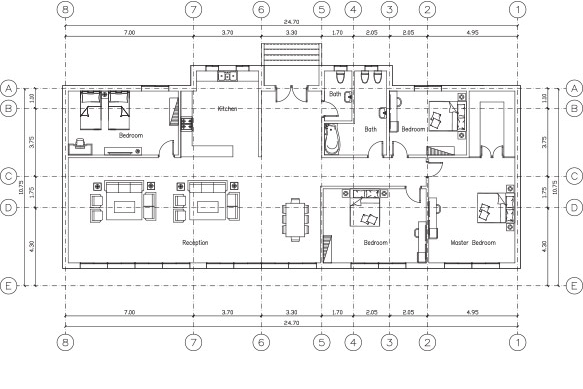

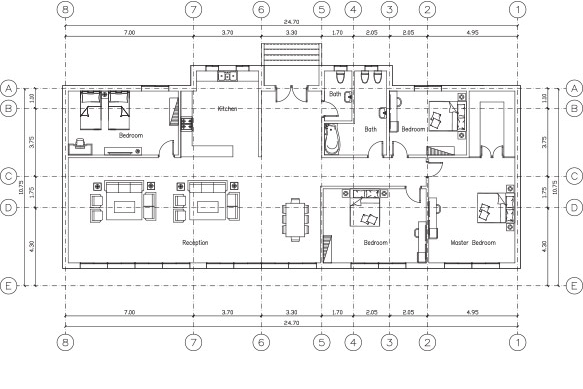

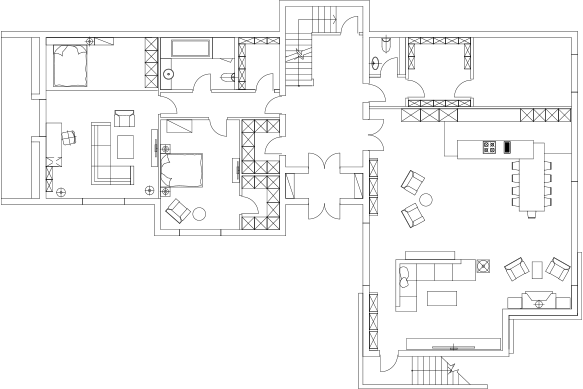

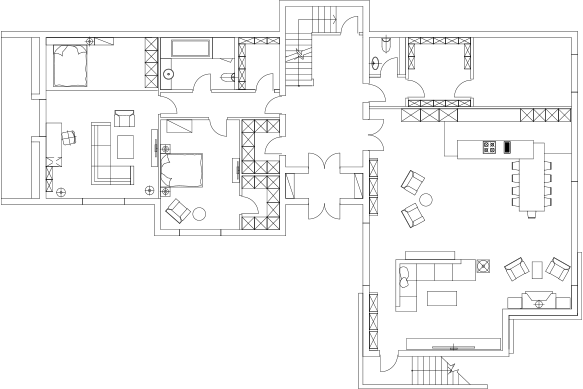

Bungalow Plans

Customize bungalow plans according to your own requirement

Example Title 1

Author

occupation

Example Title 2

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Mauris tempus nisl vitae magna pulvinar laoreet.

Author

occupation

Example Title 3

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Mauris tempus nisl vitae magna pulvinar laoreet.

Author

occupationstylish news from our blog read, enjoy & learn

At vero eos et accus amuset iusto odio

No posts were found for provided query parameters.

Request a visit

TO ENQUIRE ABOUT THE PROJECTS PLEASE CONTACT 9727709927